Note: The following e-newsletter was distributed to Sen. Leonard Christian’s subscribers Feb. 28, 2025. To subscribe to Sen. Christian’s e-newsletters, click here.

Dear Friends and Neighbors,

News reports indicate the city of Spokane is planning to install as many as 10 new traffic cameras around town, ostensibly to encourage motorists to drive slower and safer. The fact that they could generate millions of dollars every year in fines is merely incidental.

Some might be suspicious of the city’s motivations, given the fact that it is trying to close a $50 million budget deficit. But I have a solution that would eliminate any doubt. I have introduced a bill that would eliminate most financial incentives for cities to install traffic cameras, and could help stave off a devastating transportation tax at the same time. That’s the dreaded Road Usage Charge, which I’ll tell you about in a moment.

Senate Bill 5757 would allocate 50 percent of revenue from traffic cameras to the state motor vehicle fund, where the money would be used to fix our roads and highways. When people get a ticket in the mail from a robotic camera, they would know their money is going to fill potholes, and not holes in the city budget.

Bill remains in play

This bill got a hearing this week in the Senate Transportation Committee. Because it has an impact on the state transportation budget, it remains under consideration until we adjourn our session April 27, and we may see it surface when we begin debating transportation spending a few weeks from now. We can’t be sure how much this proposal would generate, because the state doesn’t track local traffic-cam receipts. But we are told the city of Seattle last year collected $15 million from red-light cameras and cameras installed in school zones. That’s big money.

Let me answer an obvious question: The state would not be installing traffic cameras to pay for the state transportation budget. The state doesn’t install cameras. Cities install them. By diverting half the revenue to the state, this bill would ensure cities are installing cameras for their stated purpose, to promote safer driving. Current state law would earmark 25 percent of the remaining revenue for bicycle lanes and other improvements. This would leave cities with more than enough money to pay for camera operations and ticketing. In a year when we are considering alternatives to the gas tax to pay for road construction and maintenance, small-scale proposals like this one could go a long way.

Road Usage Charge debate heats up

Tracking devices, double taxation are possible pitfalls

At first this tax would be based on odometer readings, but government tracking devices are a possibility. / Credit: CC0-Alan Levine

Right now Olympia is considering a new tax on motoring that could have a devastating impact on all of us who live in Eastern Washington and drive long distances. Proposals under consideration in the House and Senate would impose a tax of 2.6 cents per mile, plus another 10 percent to pay for transit, bike lanes and so forth. The idea is that we need to find a new way to pay for roads and highways as we prepare for the day that electric vehicles become commonplace and gas tax collections fall.

I think we all get that, but what a terrible solution this is! No one has worked out a good way to track the miles we drive on state roads. I don’t think any of us want government tracking devices in our cars. The bills we are considering initially would create a “voluntary” program based on odometer readings, but how would we tell which miles are driven in-state versus out-of-state? The cost to collect this tax would be huge, somewhere between 8 and 12 percent. By comparison, our current gas tax costs about one-half of one percent to collect.

Double taxation is another likely possibility. This is supposed to supplant the gas tax, yet we have to keep gas taxes in place because the state has issued bonds against it. So these proposals envision complicated tax-credit programs that would be very difficult, if not impossible to administer. State agencies have already failed their statutory obligation to develop a similar program to exempt farmers from climate-change taxes on fuel. They say it’s too hard. Farmers are stuck with the tax. Why would this be any different?

Republicans are proposing sensible and easy-to-implement alternatives, like dedicating sales taxes on motor vehicles to highway purposes. Or sales taxes on auto parts and tires. And this is where proposals like my traffic-camera bill come in. We don’t have to work very hard to come up with better ideas than this one.

What are they thinking?

Committee cutoff edition

Last Friday was the deadline for policy committees to pass bills that will be advancing this session. Here are a few of the terrible proposals that survived the cutoff and could be debated soon in the House and Senate.

- Senate Bill 5098 — Prohibiting the possession of guns at parks, playgrounds, county fairs and most public buildings — This bill, yet another attempt to impair Second Amendment rights by criminalizing otherwise-lawful firearms possession, passed the Senate Transportation Committee Thursday.

Mindblow score:

- Senate Bill 5041 – Unemployment insurance for striking workers – This bill would penalize employers with higher unemployment insurance costs when unions choose to strike.

- Senate Bill 5434 – Governor’s emergency powers reform – This started out as a bill worked out between Republicans and the governor to place reasonable limits on executive branch authority, but last week a Democratic committee chair insisted on passing a different version that reduces the Legislature’s powers and makes current law even worse.

- House Bill 1339 – Shifting local elections to even-numbered years – This bill would crowd general election ballots with local races, reducing focus on local issues, and reducing opportunities for the people to place initiatives on the ballot.

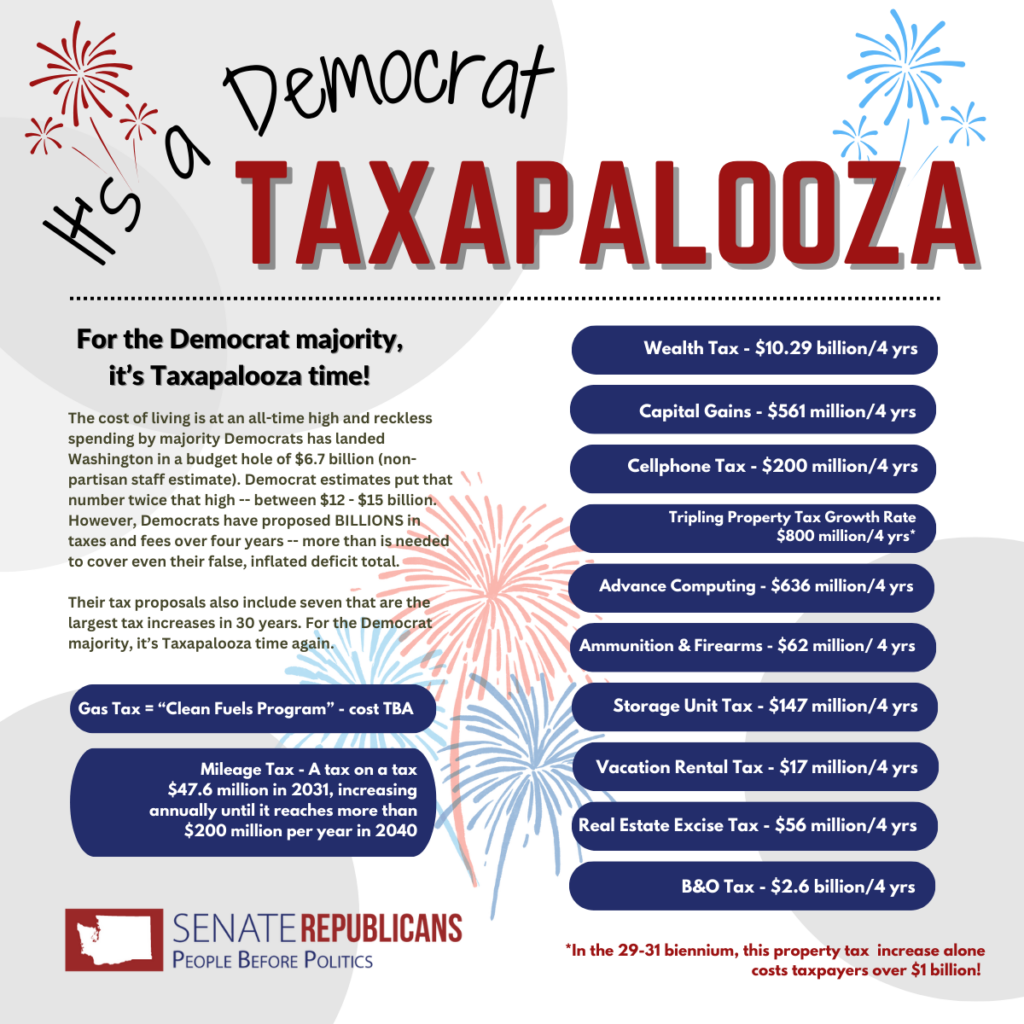

Think these are bad? Here’s a look at some of the tax proposals coming our way as we turn our focus to the budget.

Reminder: Town Hall meeting set for March 15

I’ll be holding a town hall meeting in Spokane Valley on Saturday, March 15. We’ll be discussing the 2025 legislative session, and I am looking forward to your questions. This meeting will be at Sun City Church, 10920 East Sprague Ave. in Spokane Valley. Doors open at 9:30 a.m. and the town hall is from 10 a.m. to 11 a.m. I hope you can make it!

Thanks for reading,

Leonard Christian

4th Legislative District

Contact us!

If you have a concern about state government, or a problem with a state agency, please do not hesitate to contact my office. My most important duty is to serve you.

If you have a concern about state government, or a problem with a state agency, please do not hesitate to contact my office. My most important duty is to serve you.

Mailing address: Post Office Box 40404, Olympia, WA 98504

Email: Leonard.Christian@leg.wa.gov

Phone: (360) 786-7606

Leave a message on the Legislative Hotline: 1 (800) 562-6000