The following e-newsletter was sent to Sen. Leonard Christian’s subscribers April 4, 2025. To subscribe to Sen. Christian’s e-newsletters, click here.

To see speech, click here or on video above.

During Saturday’s debate on the budget, I warned against basing our budget on a “wealth tax” – a tax on a handful of super-rich Washingtonians who can easily pick up and move someplace else. This isn’t money we can count on. Gov. Bob Ferguson made the same point three days later when he promised to veto any budget that resembles this one.

Dear Friends and Neighbors,

Could our debate on budget and taxes in Olympia this year get any wilder? In just the last week:

- House and Senate Democrats passed budget proposals requiring taxes so big that the state of Washington might never recover,

- Our governor rebuked his own party by declaring he would veto any proposal that looks like these,

- Washington’s largest employers warned of dire consequences to the state’s economy if this year’s anti-business tax proposals are passed, and

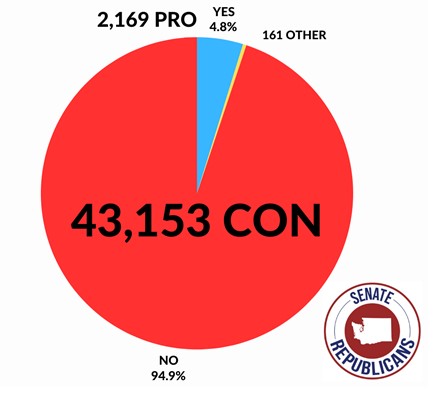

- A record number of Washingtonians – 43,000 of them – registered their opposition to a another element of the package, a bill allowing property taxes to skyrocket.

Public opinion is turning against our majority colleagues in their effort to pass the biggest tax increase in Washington history — in the neighborhood of $20 billion, depending on how it is counted. They need a Plan B, and fast. There are just three weeks to go in our legislative session, and we are scheduled to adjourn April 27.

The Legislature could avoid tax increases entirely if it resists new non-emergency spending. But our colleagues appear determined to continue the rapid spending growth of the last decade, they want big new taxes to cover it, and already they are looking for new ones. In the session’s final weeks, taxpayers can’t rest easy.

On Thursday, our colleagues voted to send the budget bill to a conference committee. Now the negotiations move behind closed doors and out of public view. Once a final deal is reached, the full Legislature likely will have only a few hours’ notice before we are expected to vote. Who’s to say the deal our friends come up with won’t be worse?

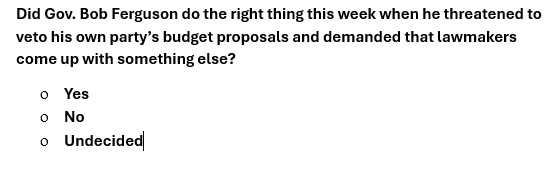

Governor lays down the law

This story from KREM-TV describes the governor’s ultimatum to the Legislature. It was my honor to present the Republican view. We appreciate the pressure the governor is bringing to bear on his own party to force greater fiscal responsibility.

Alarm from business community

Washington’s leading businesses are warning that the tax proposals from our colleagues threaten our state’s economy. These include a payroll tax, paid by business, on high-paying jobs – think of it a high-earners income tax in disguise. Majority lawmakers also want a first-in-the-nation “wealth tax,” sort of a property tax on stocks, bonds and other investments. The warning, from Alaska Airlines, Amazon, Costco, Microsoft and other Washington-based businesses, was contained in a letter Wednesday that reads in part:

“These proposals would result in the largest tax increases in state history, perpetuating a dangerous trend of unsustainable spending growth. Over the past decade, the state operating budget has more than doubled, with a 37 percent increase in just the last four years. This growth far exceeds state increases in population, inflation and personal income, threatening our economic stability.”

Record opposition to property taxes

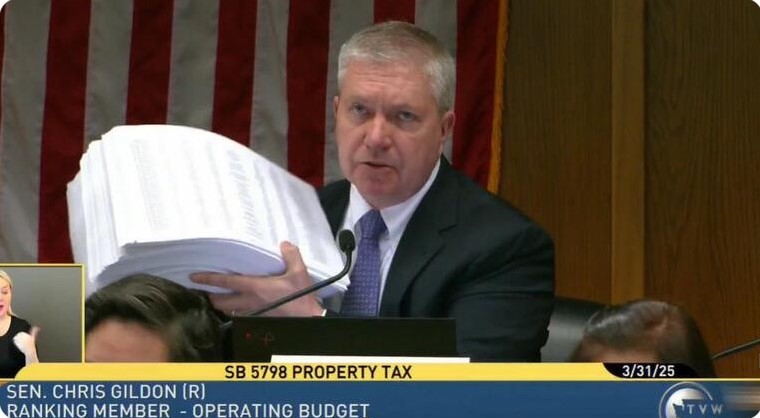

Republican budget lead Chris Gildon, R-Puyallup, delivers a printout with 43,153 electronic signatures to the Senate Ways and Means Committee.

Thanks to you, our majority colleagues know they have crossed a line with their proposal to unleash massive property taxes. A record number of Washingtonians registered their opposition to SB 5798 when the bill got a hearing in the Senate Ways and Means Committee Monday. Some 43,153 people signed in “con,” the largest number of people ever to express their concerns with a single bill.

This bill would eliminate a limit on property taxes that can be imposed by local governments without a public vote. This would allow our colleagues to shunt more expenses to the county level and allow state spending to continue to skyrocket. Had this measure been in place over the last 10 years, your property taxes could be 50 percent higher today, and because of the compounding effect, they would just keep growing. The House is considering a similar measure. These steep increases would impose a massive burden on the middle class families and would ensure many Washington homeowners would be taxed out of their own homes.

Let us remember, if local governments want significant increases in property taxes, nothing is stopping them from asking voters for permission. With this legislation, what our colleagues are really trying to do is to cut the people out of the decision.

If the public could vote on this proposal for massive increases in the property tax, it would go down in flames. Sign-ins at Monday’s hearing on SB 5798 were 95 percent opposed.

SURVEY QUESTION:

An ultimatum from the governor

Please take a moment to answer this week’s survey, by clicking here.

Reader poll:

Your views on transportation taxes

Speed-up for North-South Freeway doesn’t justify perpetual gas tax increases, readers say

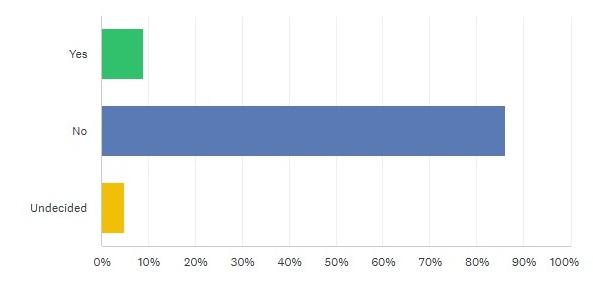

Can we justify a gas-tax increase if it gets the North-South Freeway finished any sooner? This was the big question for Spokane-area lawmakers last Saturday when a proposal for a six-cent-a-gallon increase came up for a vote. The Senate voted yes. I voted no. And in last week’s poll question, so did you, by overwhelming numbers.

The House and Senate are considering proposals that would accelerate construction of big-ticket highway projects statewide. Under these proposals, construction on the last leg of the North-South Freeway would begin in 2029-31; without it, we would see the final connection to I-90 in the 2030s.

Under the Senate proposal, Washington’s gas tax would rise initially to 55.4 cents a gallon, fourth-highest in the country, and it would keep on rising. The justification for this latest increase is that gas-tax receipts are declining as electric vehicles take hold. So the Senate is proposing that the gas tax automatically increase 2 percent a year, forever. The House uses a similar mechanism that would result in even higher taxes.

Some 86 percent of you said a quicker finish to the North-South Freeway isn’t enough to justify this increase. I think this shows what happens when promises are broken too many times. Every gas tax increase we have seen in the last 40 years has been sold to the Spokane area with the promise that it will build the freeway. Then we get another mile down the road and we’re out of money again.

What this will really do is send more of us to fill up in Idaho just a few miles away, where fuel is about a dollar a gallon less expensive than in this state. We lose other business as well to the retailers who have set up just over the border.

This isn’t the only proposal we face this year that would raise gas prices – also on the table this session is a plan to ratchet up the requirements of our costly and unworkable low carbon fuel standards law. The higher the taxes in our state, the greater our losses will be in border areas like the 4th Legislative District. And the more we lose, the greater the pressure will be to raise taxes still further. I voted no on this bill to end this never-ending spiral.

Thanks for reading,

Leonard Christian

4th Legislative District

Contact me!

|

If you have a comment about state government, or a concern with a state agency, I hope you will reach out to my office. My most important duty is to serve you.

Mailing address: Post Office Box 40404, Olympia, WA 98504 Email: Leonard.Christian@leg.wa.gov Phone: (360) 786-7606 Leave a message on the Legislative Hotline: 1 (800) 562-6000 |